After more than a decade of near-zero interest rates, bonds have regained their role as a core building block in a portfolio, offering reliable income, principal preservation and diversification to equities and other risk assets. Investors allocating to bonds typically follow one of two approaches: a buy-and-hold ladder or an actively-managed bond portfolio. While both aim to provide income and mitigate risk, they differ significantly in strategy, flexibility, and potential outcomes.

In this article, we’ll cover the basics of each approach and offer important considerations for investors when deciding which might be best for them.

What is a Bond Ladder?

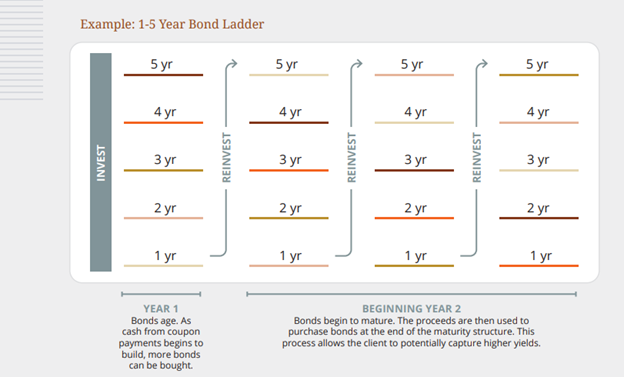

A bond ladder is a rules-based strategy that invests in bonds with staggered maturities across a set maturity range. As bonds mature and coupon payments accumulate, proceeds are reinvested at the long end of the ladder’s range. In a normal market environment where the yield curve slopes upward, longer-dated bonds will typically offer higher yields.

This rolling reinvestment structure helps smooth reinvestment risk, manage interest rate exposure, and generate a predictable stream of income. Additionally, passive ladder offerings tend to have lower fees than actively managed strategies.

1-5 Year Bond Ladder Example

1-5 Year Bond Ladder Example

Bond ladder portfolios do not have to be entirely passive. At Madison Investments, our ladder portfolios apply the expertise of our credit research team to select and monitor the credits within the portfolio. While trading in a ladder portfolio is rare, the team at Madison will swap bonds in the event of a credit deterioration.

What is an Actively Managed Bond Portfolio?

An actively managed bond portfolio is designed to respond to changing market conditions and capitalize on opportunities. Professional managers make ongoing buy and sell decisions to align with an investment objective, such as enhancing returns or mitigating risk.

For example, a manager might favor higher-quality bonds if they see valuation risks, or tilt toward certain sectors or maturities based on their outlook for credit conditions or interest rates. Unlike the more passive nature of ladders, active management offers flexibility to reposition quickly as markets evolve.

Because bond prices move as interest rates change, this dynamic approach also creates the potential for capital appreciation, an outcome not typically available in a buy-and-hold ladder.

Bond Ladder vs. Actively Managed Bond Portfolio: Key Differences

Investment Approach

- Bond Ladder: Rules-based; buy and hold

- Actively Managed Portfolio: Dynamic; research-driven

Income and Return Potential

- Bond Ladder: Predictable income, limited upside potential

- Actively Managed Portfolio: Potential for higher returns, but more variability

Flexibility

- Bond Ladder: Static until bonds mature (unless sold)

- Actively Managed Portfolio: Can quickly shift positions, manage flows, or capture opportunities.

Reinvestment Risk

- Bond Ladder: Varies – As bonds mature, reinvestments are subject to market rates

- Actively Managed Portfolio: Managers can reallocate before maturity and are not bound to a set schedule

Interest Rate Risk (duration)

- Bond Ladder: Minimal – Bonds held to maturity avoid realized price changes

- Actively Managed Portfolio: Yes – Portfolios are sensitive to rate moves, allowing for both gains and losses

Which Strategy Is Right for You?

A bond ladder can provide stability, predictability, and simplicity for investors seeking steady income and limited interest rate sensitivity. An actively managed bond portfolio, on the other hand, offers the potential for capital appreciation, tactical flexibility, and oversight to adapt as markets shift. The right strategy will depend on an investor’s goals, risk tolerance, and need for flexibility.

Fixed Income Strategies at Madison Investments

Madison Investments offers both actively managed and ladder strategies, each designed to leverage our proprietary credit research and institutional trading expertise for the benefit of our clients. To learn more about Madison’s bond ladders and actively managed SMA offerings, speak with the regional director in your area.