The U.S. equity market offers diverse investment opportunities, from large, stable companies to fast-growing startups. While many investors focus on large, well-known companies or chase the allure of high-growth startups, mid cap stocks are often overlooked. Mid caps, however, should not be ignored, as over the long term, they have delivered higher risk-adjusted returns than both small and large caps.

What Defines a Mid Cap Company?

Mid cap companies are defined by a market capitalization typically between $1 billion and $60 billion. There is usually some overlap between large and mid, and mid and small, as can be seen in market indexes like the Russell 1000 Index, where the bottom 800 companies form the Russell Midcap Index. The 800-stock overlap between the Russell 1000 and Russell Midcap Indices, however, is not as significant as it may seem. Due to weighting by market capitalization, the Russell Midcap Index only represents around 27% of the Russell 1000.

Why Invest in Mid Caps?

Mid cap stocks offer a unique investment opportunity, balancing stability and growth potential as they are more established than small caps but grow faster than large caps. Often overlooked and under-researched, mid caps present opportunities for investors to find undervalued, resilient businesses with the nimbleness to thrive in changing economic conditions.

The "Sweet Spot" for Growth

Mid cap companies tend to be more stable and established than small caps but grow faster than more mature large caps, occupying a sweet spot of the enterprise life cycle with the potential for substantial growth. As they mature beyond the rapid growth phase of small caps, they become more stable and reliable while still offering greater growth prospects than large caps. This balance makes mid caps appealing for active managers, who can capitalize on market inefficiencies to identify promising companies positioned to become the next large cap success stories at attractive valuations.

Overlooked & Undervalued

Mid cap stocks are typically less researched by buy-side and sell-side analysts compared to large cap stocks, providing skilled stock pickers the chance to generate significant value.

Mid cap stocks represent a significant portion of the U.S. equity market—about 20%—but they only account for 9% of investment exposure (as of 12/31/2024). With mid caps being under-allocated and overlooked, it’s not surprising that so many investors are still unaware of the benefits of mid cap investing.

Agile & Resilient

Mid cap business models tend to be more diversified and profitable than smaller companies and less complex than large caps, giving them a greater ability to adapt to changing economic conditions.

Mid Cap Performance Over Time

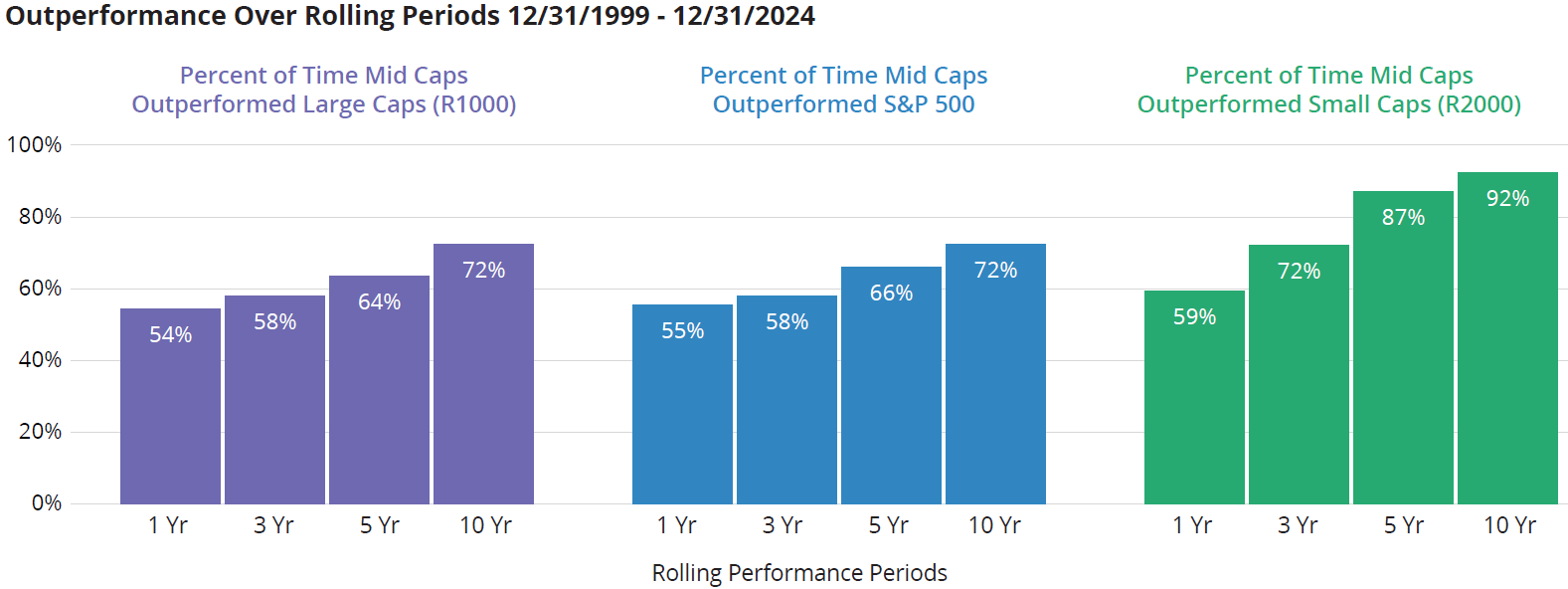

The case for mid caps becomes even more compelling when examining historical performance. Over multiple long-term rolling periods, mid caps have outperformed their large and small cap counterparts a majority of the time.

Outperformance Over Rolling Periods 12/31/1999 - 12/31/2024

Outperformance Over Rolling Periods 12/31/1999 - 12/31/2024

Mid Caps in an Investment Portfolio

Given the balance of growth and stability, we believe investors should consider a standalone allocation to mid cap stocks. For a detailed analysis of mid caps vs. large and small caps, download the full paper here:

About Madison Mid Cap

Madison Mid Cap captures the unique market opportunity of mid cap stocks through an actively managed, high-conviction, and high-quality approach that focuses on long-term growth at a reasonable price. With over 20 years of proven investment process, each holding is viewed as a long-term investment in a durable business poised for long-term shareholder value.