“Madison” and/or “Madison Investments” is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC (“MAM”), and Madison Investment Advisors, LLC (“MIA”). MAM and MIA are registered as investment advisers with the U.S. Securities and Exchange Commission. Madison Funds are distributed by MFD Distributor, LLC. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority. The home office for each firm listed above is 550 Science Drive, Madison, WI 53711. Madison’s toll-free number is 800-767-0300.

Any performance data shown represents past performance. Past performance is no guarantee of future results.

Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.

This website is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security and is not investment advice.

In addition to the ongoing market risk applicable to portfolio securities, bonds are subject to interest rate risk, credit risk and inflation risk. When interest rates rise, bond prices fall; generally, the longer a bond’s maturity, the more sensitive it is to this risk. Credit risk is the possibility that the issuer of a security will be unable to make interest payments and repay the principal on its debt. Bonds may also be subject to call risk, which allows the issuer to retain the right to redeem the debt, fully or partially, before the scheduled maturity date. Proceeds from sales prior to maturity may be more or less than originally invested due to changes in market conditions or changes in the credit quality of the issuer.

Basis point: one-hundredth of a percent.

Federal Funds Rate: the target interest rate range set by the Federal Open Market Committee (FOMC) for banks to lend or borrow excess reserves overnight. It influences monetary and financial conditions, short-term interest rates, and the stock market.

Duration: a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Duration measures how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows.

Bond Spread: the difference between yields on differing debt instruments of varying maturities, credit ratings, and risk, calculated by deducting the yield of one instrument from another.

Option-adjusted spread (OAS): the yield spread of a bond over a risk-free rate, usually a similar maturity Treasury, adjusted for the bond’s embedded options. It reflects the additional return investors require to compensate for the risks and potential changes in cash flows due to options such as a bond’s callability.

Yield to Maturity: measures the annual return an investor would receive if they held a particular bond until maturity as of the end of a report period. In order to make comparisons between instruments with different payment frequencies, a standard yield calculation basis is assumed. This yield is calculated assuming semiannual compounding.

Yield to Worst: the lowest potential yield that can be received on a bond without the issuer actually defaulting. The yield to worst is calculated by making worst-case scenario assumptions on the issue by calculating the returns that would be received if provisions, including prepayment, call, or sinking fund, are used by the issuer.

Effective Duration: a measure of a portfolio’s interest-rate sensitivity. The longer a portfolio’s duration, the more sensitive the portfolio is to shifts in interest rates.

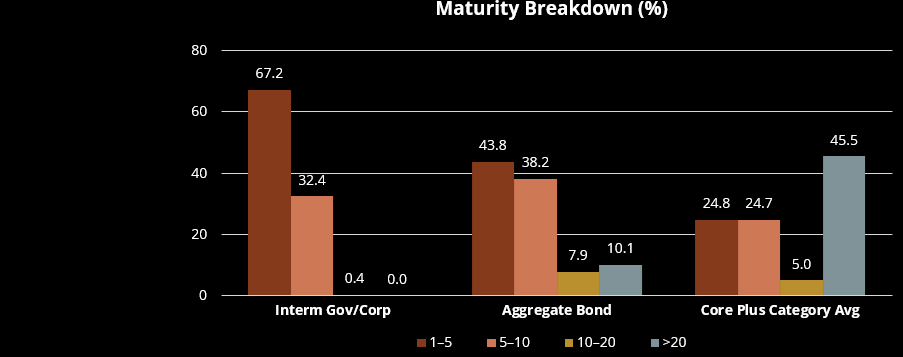

Average Maturity: computed by weighting the maturity of each security in the portfolio by the market value of the security, then averaging these weighted figures.

Yield Curve: a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity. There are three main types of yield curve shapes: normal (upward-sloping curve), inverted (downward-sloping curve), and flat.

High-Yield Bonds: Also known as junk bonds, high-yield bonds are bonds issued by companies that are considered to be at a greater risk of failing to make interest and principal payments on schedule.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only, and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance.

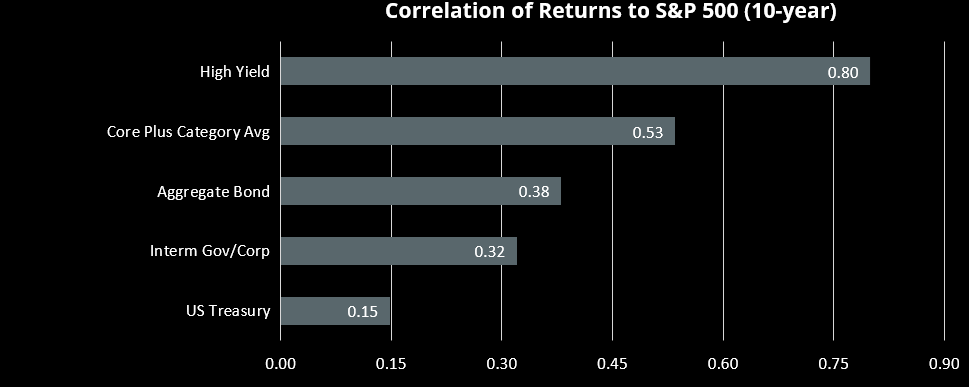

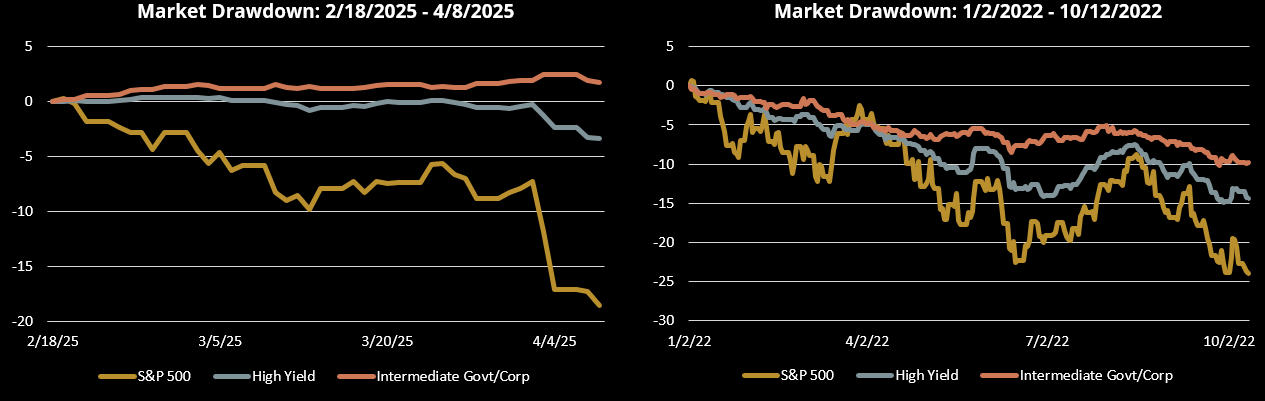

S&P 500 Index: a large cap market index that measures the performance of a representative sample of 500 leading companies in leading industries in the US.

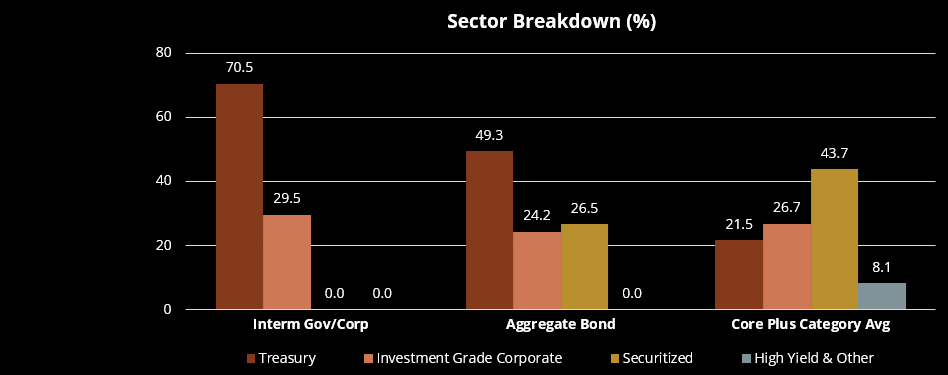

Bloomberg US Aggregate Bond Index: a broad-based, flagship benchmark that measures the investment-grade, USD-denominated, fixed-rate, taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and corporate securities, with maturities greater than one year.

Bloomberg US Corporate High Yield Bond Index: measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Barclays EM country definition, are excluded.

Bloomberg US Intermediate Government/Credit Bond Index: measures the performance of USD-denominated US Treasuries, government-related and investment-grade US corporate securities that have a remaining maturity of greater than or equal to 1 year and less than 10 years.

Bloomberg US Treasury Long Index: measures USD-denominated, fixed-rate, nominal debt issued by the US Treasury with 10 years or more to maturity.

Morningstar Core Plus Bond category: designed for investment in investment-grade US fixed-income issues, including government, corporate, and securitized debt. These funds generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loans, emerging-markets debt, and non-US currency exposures